Getting My Pvm Accounting To Work

Getting My Pvm Accounting To Work

Blog Article

Little Known Questions About Pvm Accounting.

Table of ContentsThe Pvm Accounting DiariesGetting The Pvm Accounting To WorkThe Only Guide for Pvm AccountingPvm Accounting Things To Know Before You Get ThisUnknown Facts About Pvm AccountingThe Pvm Accounting PDFs

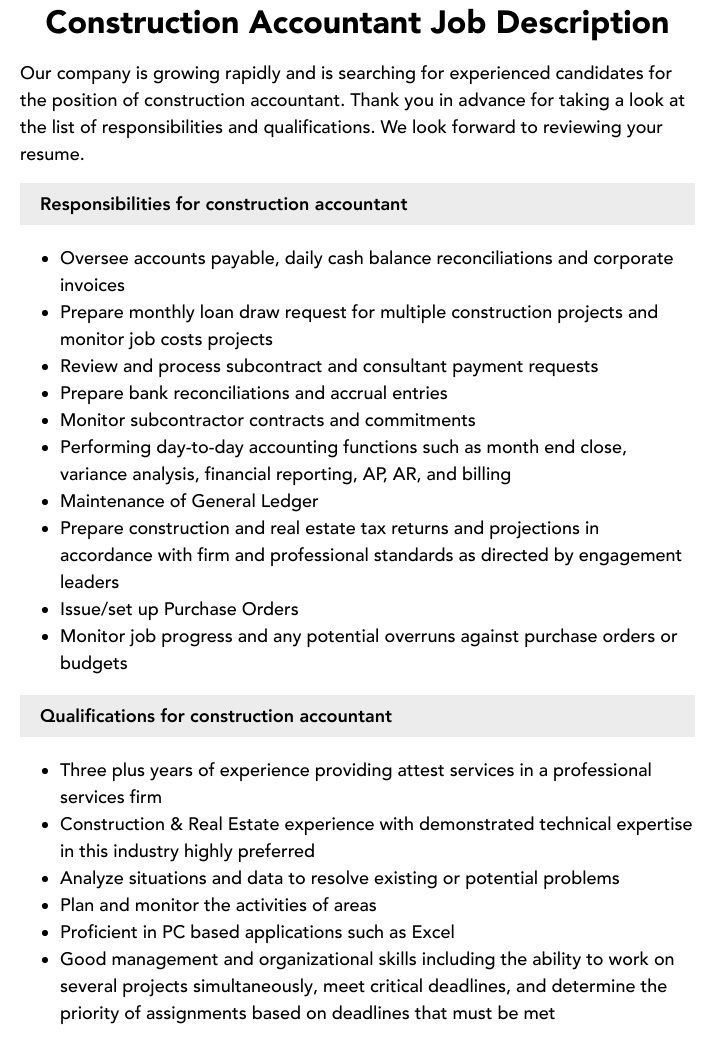

Make sure that the accountancy procedure complies with the legislation. Apply called for construction accountancy criteria and procedures to the recording and reporting of building task.Understand and maintain typical expense codes in the accounting system. Connect with various funding companies (i.e. Title Firm, Escrow Company) concerning the pay application process and needs required for settlement. Manage lien waiver disbursement and collection - https://hearthis.at/leonel-centeno/set/pvm-accounting/. Screen and settle financial institution concerns including fee anomalies and inspect distinctions. Assist with applying and maintaining internal monetary controls and treatments.

The above statements are meant to explain the basic nature and degree of job being executed by individuals appointed to this category. They are not to be construed as an extensive listing of obligations, tasks, and abilities needed. Workers may be required to carry out duties outside of their typical responsibilities once in a while, as required.

5 Easy Facts About Pvm Accounting Shown

You will help sustain the Accel group to guarantee distribution of effective on schedule, on spending plan, projects. Accel is looking for a Building and construction Accountant for the Chicago Office. The Building Accountant performs a variety of audit, insurance conformity, and job administration. Functions both independently and within specific divisions to preserve financial records and make certain that all documents are kept existing.

Principal tasks consist of, but are not limited to, taking care of all accounting functions of the business in a prompt and exact manner and supplying records and schedules to the business's CPA Firm in the prep work of all economic declarations. Makes sure that all bookkeeping treatments and features are managed precisely. Responsible for all monetary documents, pay-roll, financial and daily operation of the accountancy feature.

Prepares bi-weekly trial balance reports. Works with Project Supervisors to prepare and upload all monthly billings. Procedures and concerns all accounts payable and subcontractor settlements. Creates month-to-month wrap-ups for Workers Compensation and General Liability insurance costs. Creates month-to-month Work Expense to Date reports and working with PMs to reconcile with Task Supervisors' budget plans for each job.

Indicators on Pvm Accounting You Should Know

Proficiency in Sage 300 Construction and Property (formerly Sage Timberline Workplace) and Procore construction administration software an and also. https://worldcosplay.net/member/1768246. Must additionally be efficient in other computer system software systems for the prep work of reports, spreadsheets and other accounting evaluation that may be needed by monitoring. construction accounting. Need to possess strong business skills and capability to focus on

They are the financial custodians that ensure that building tasks remain on budget plan, adhere to tax obligation policies, and preserve economic transparency. Building accounting professionals are not simply number crunchers; they are tactical companions in the building and construction process. Their primary function is to handle the economic facets of construction projects, making sure that sources are allocated efficiently and economic dangers are decreased.

The 9-Second Trick For Pvm Accounting

By maintaining a limited grasp on task funds, accounting professionals help prevent overspending and economic setbacks. Budgeting is a cornerstone of successful construction jobs, and construction accounting professionals are critical in this regard.

Navigating the facility web of tax obligation laws in the building market can be challenging. right here Building accounting professionals are well-versed in these laws and ensure that the project complies with all tax requirements. This consists of managing payroll tax obligations, sales taxes, and any kind of other tax obligation obligations certain to building. To succeed in the function of a construction accounting professional, individuals need a strong educational foundation in accounting and financing.

In addition, certifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Expert (CCIFP) are extremely related to in the market. Construction jobs commonly include limited due dates, altering policies, and unexpected expenses.

Excitement About Pvm Accounting

Specialist accreditations like certified public accountant or CCIFP are additionally highly suggested to show know-how in construction bookkeeping. Ans: Building accountants produce and keep an eye on budget plans, identifying cost-saving possibilities and making certain that the task remains within budget plan. They likewise track costs and forecast financial demands to avoid overspending. Ans: Yes, construction accountants take care of tax compliance for building and construction tasks.

Introduction to Building Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make difficult choices amongst lots of economic options, like bidding on one task over another, picking financing for products or equipment, or establishing a project's earnings margin. Building is an infamously volatile sector with a high failure price, slow-moving time to repayment, and irregular cash flow.

Common manufacturerConstruction company Process-based. Production involves duplicated procedures with conveniently recognizable expenses. Project-based. Production requires different procedures, products, and devices with varying costs. Fixed location. Manufacturing or manufacturing takes place in a solitary (or a number of) regulated locations. Decentralized. Each job takes place in a new place with differing website problems and one-of-a-kind challenges.

The 2-Minute Rule for Pvm Accounting

Lasting connections with suppliers relieve arrangements and boost efficiency. Irregular. Frequent use of various specialty service providers and suppliers influences efficiency and cash circulation. No retainage. Settlement arrives completely or with normal payments for the full contract amount. Retainage. Some part of settlement might be held back until job completion also when the service provider's job is finished.

Routine production and short-term agreements lead to manageable cash flow cycles. Irregular. Retainage, slow payments, and high in advance costs result in long, irregular cash flow cycles - financial reports. While conventional producers have the advantage of regulated atmospheres and enhanced production procedures, building companies must frequently adjust to every new task. Even somewhat repeatable jobs need modifications as a result of website conditions and various other elements.

Report this page